CORPORATIVO ACTUARIAL DE MAPFRE | photographs ISTOCK

Insurance offers value to society, where concepts such as protection, health, and safety are highly coveted in such dramatic circumstances as the situation we have been through. From a customer perspective, this protection and search for safety has materialized unequally in accordance with the insurance needs created by the pandemic. In this sense, sales of some insurance modalities, such as health or burial insurance, have increased.

The pandemic has brought an acceleration of the digitalization process in the insurance sector that had been gradually progressing over recent years

Health has become a priority

As regards burial insurance, we have continued to see positive growth figures in 2020 compared to numbers from the previous year.

In the case of illness insurance, health has become a priority and customers value having access to healthcare without waiting lists and the possibility of directly seeing a specialist, without any restrictions on healthcare provision capacity.

As regards burial insurance, we continued to see positive growth figures in 2020 compared to issuing values from previous years in markets where this modality is sold.

In the case of other modalities such as automobile or home insurance, there have been no significant changes in sales volumes, but prices have decreased slightly as the reduction in the loss ratio was passed on to policyholders.

In addition, one of the factors that has been most strongly affected by COVID-19 limitations is travel, which saw a very significant decrease in the number of trips. Customers want insurance options that protect them against the financial consequences of cancellations or travel restrictions. A similar trend can be seen in event cancellation insurance, where interest in underwriting has substantially increased.

Now that we have established the main changes in customer consumption habits in insurance underwriting due to COVID-19, it is time to ask ourselves the million-dollar question: Will these changes in behavior patterns related to insurance continue, increase, or decrease in the medium and long term?

As anticipated in the sentence that opened this article, the answer is not simple and is full of uncertainty. To respond to this question we could define some trends that could continue into the medium and long term.

The consolidation of our “new normal” will bring some opportunities to sell new products resulting from changes in our lifestyle habits. One of these is remote working, which has almost become standard practice. This new online way of working will open up opportunities in some modalities, such as cyber insurance.

Digitalization is another trend that looks like it is here to stay. Beyond the exceptional lockdown situations that caused a substantial increase in online purchases during these periods, it would appear that sales through this channel will slowly increase compared to the pre-pandemic situation. Nonetheless, digital channels will not be the only aspect taken into account when it comes to taking out insurance; advice will also be highly valued in underwriting. These two effects could contribute to the phygital revolution (fusion of the physical and digital worlds).

The public sector will continue to play a very important role in meeting citizens’ needs, but given the high levels of government debt, opportunities will probably be created for policies that complement public coverage with health insurance or pension plans for aging populations.

Technological advances and sustainability will change the vehicle fleet, which, teamed with changes in the way people move around such as the use of shared vehicles, will gradually modify the range of products offered by insurance companies related to automobile insurance.

An alternative viewpoint to help us understand future insurance consumption behavior involves analyzing the evolution of age cohorts over time, as insurance needs and the way people access insurance will change in step with the evolution of the generations that make up the population pyramid. The population pyramid can currently be represented by the following age groups:

- The Silent Generation. This cohort includes people born between 1930 and 1948.

- Baby Boomers. People born between 1949 and 1968.

- Generation X, those born between 1969 and 1980.

- Generation Y, or millennials, those born between 1981 and 1993.

- Generation Z, those born between 1994 and 2010.

- Generation Alpha, those born after 2011.

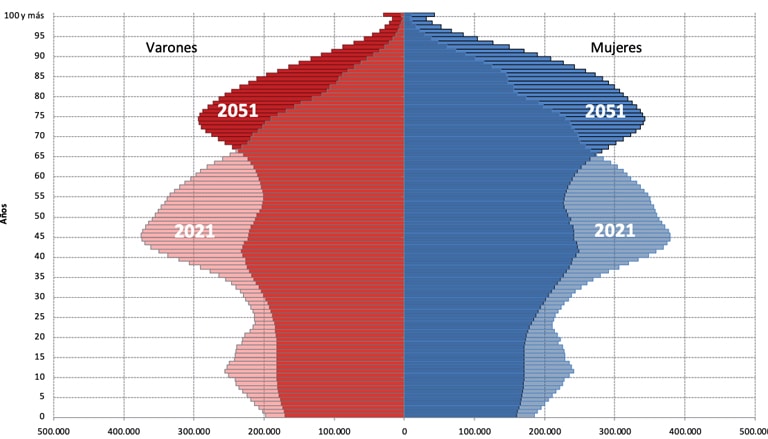

Evolution of population pyramids in Spain 2021 and 2051

Source: Elaborated in house based on long-term forecasts from the INE.

As you can see in the chart above, the aging of the population pyramid and the mortality of cohorts will mean that millennials and subsequent generations will go from representing 43% of the population in 2021 to more than 71% in 2051. These groups could substantially increase their purchasing power in the coming years; consequently, the insurance offering should be focused on this cohort’s consumption behaviors. These generations are digital natives, as they are the first to have been born and bred with Internet and cellphones. Another defining characteristic of the millennial lifestyle is the fact that they push back important life decisions such as getting married, having children, or buying a house. The also generally have a higher level of education than other generations and good technological knowledge.

The decision to put off buying a house and car because shared use is now possible in both these cases may create opportunities to sell new forms of insurance to this population segment. As for purchasing insurance, several studies highlight the importance of a hybrid approach based on multichannel information, with an advisory service that has no time restrictions or waiting times and where cellphones become a gateway to carry out transactions with insurers.

Many studies are unsure whether the different habits shown by these population cohorts when it comes to purchasing insurance are temporary and will only continue until they experience important events such as buying a house or getting married, which would mean that they are merely delaying the behavior of previous cohorts, or if, by contrast, this change is here to stay. Unfortunately, only time will tell how insurance will actually change for these generations in the future. In the meantime, as insurance companies, we continue to provide answers to our customers in this uncertain environment.