TEXTO NURIA DEL OLMO| photographs MAPFRE, ISTOCK

How do natural disasters affect the insurance industry?

Thanks to insurance, society can protect itself, at least financially, from natural disasters. We are talking about extreme phenomena, and there is clearly a growing trend. This means that the cost of natural disasters continues to grow substantially decade after decade. Figures from the past 10 years are shocking: compensation paid out due to natural disasters has reached an annual average of 75 billion dollars, and total damages exceed 145 billion.

Is this all linked to climate change?

Yes, to a great extent. Every year we see more destructive catastrophic events related to atmospheric or weather-related causes, such as category 4 or 5 hurricanes. We can also mention forest fires and droughts. In the past they were considered to be less severe, but now they result in large losses. And we cannot forget one last factor: the increasing number of people exposed to these catastrophes. For example, 40% of the world’s population lives less than 60 miles from the coast, including areas that are very prone to tropical storms. Not everyone has insurance to protect them, and this makes them extremely vulnerable.

What would you highlight of the current role of the insurance sector in the prevention or management of extreme weather events?

Insurance companies want to #PlayOurPart, which involves dealing with a large portion of the damage caused by natural disasters. We have always done this, which means we have lots of experience in managing these types of risks. The better we do this, the more protected society is, and we will be more resilient in the face of climate change. A key aspect in this process is correctly quantifying the type of risk to protect our solvency and ensure that we have enough capital to pay out compensation to insured parties. Unfortunately, a lot of this damage is not insured, and this is something that should definitely change. To do so, we must continue providing viable solutions that reach more people, especially those with limited financial resources, and keep on raising social awareness of the role of insurance, which is completely necessary to ensure economic activity and consolidate the welfare state.

“It has taken us too long to identify and acknowledge the problem”

“Insurance is completely necessary to ensure economic activity and consolidate the welfare state”

“I believe that we need to change our lifestyle habits and spread the word”

What does MAPFRE do to reduce the impact of natural disasters?

We currently use a management model that allow us, for example, to identify the dangers to which we are exposed and estimate potential disaster scenarios. Consequently, we can assess the cost we may have to bear in the event of a natural disaster. All this allows us to establish appropriate financial protection and define business continuity plans to help our customers quickly.

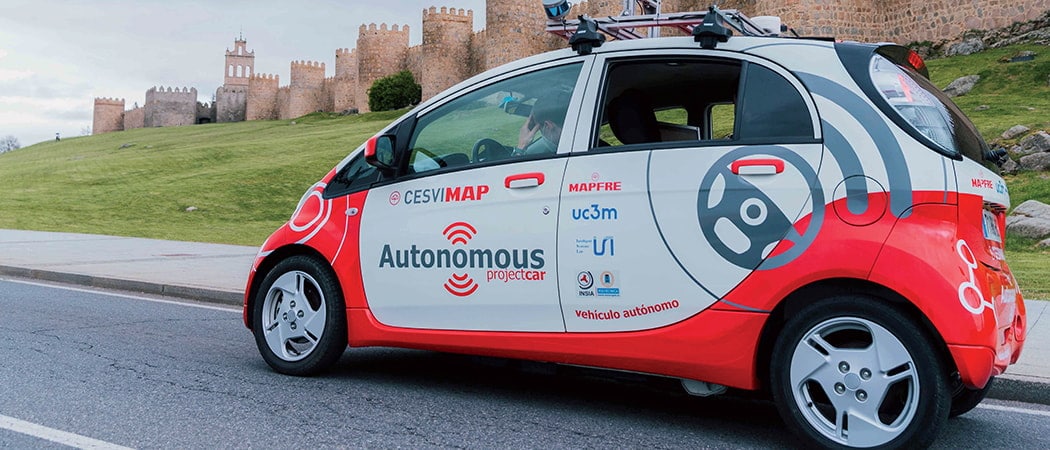

In 2017, Hurricane Maria was a real example of how to drive the reconstruction of a country that has suffered the consequences of a natural disaster.

In fact, Hurricane Maria, which devastated Puerto Rico four years ago, put our organization and customer service capabilities to the test. MAPFRE managed more than 93,000 claims (almost 25 times more than in a normal year) and was one of the few companies to leap into action right from the beginning. For example, it set up a 24-hour customer service hotline and a medical and psychological support service for employees, and it brought together a team of volunteers that gave their all to help society. I am proud to be part of a system that helps society bounce back from such a hard blow. The solvency of insurance companies is essential.

What do you think will happen in the coming years if we do not take measures to protect our planet?

I think that human beings have an amazing ability to overcome and adapt, and society will eventually evolve to become more respectful of the environment. That said, I know we are not going as fast as we would like, and this comes at a huge price. It has taken us too long to identify and acknowledge the problem, and we still have a lot of work to do to become aware of the disadvantages and react. I think that we will have a better chance of changing if we are able to explain climate change in a way that makes citizens worry.

“Hurricane Maria, which devastated Puerto Rico in 2017, put MAPFRE’s organization and customer service capabilities to the test”

How do you think that we could all help prevent or reduce the consequences of climate change?

First and foremost, I believe we need to change our lifestyle habits and make them more sustainable. For example, we should consume less energy, stop wasting water, recycle more and, without a doubt, give everything we buy a longer life. I also think that we should try and spread the word and share our views, raising awareness among our family and friends and demanding concrete and budgeted solutions from our political leaders. We all need to play an important role in this transformation.

What does MAPFRE’s commitment involve?

We have been fully dedicated to the decarbonization of the economy for many years. It is a key element of our commitment to sustainable development. The Sustainability Plan 2019–2021 includes specific objectives to protect the environment and curb the effects of climate change. Among these, MAPFRE aims to be a carbon-neutral company by 2030. To achieve this, it is implementing a number of key measures to reduce greenhouse gas emissions. Spain and Portugal in particular will reach carbon neutrality this year, which will technically offset 61% of the MAPFRE Group’s global greenhouse gas emissions. At MAPFRE, we are also working to comprehensively strengthen our environmental, social, and governance risk analysis models, both as a business and as an investor. This is part of MAPFRE’s public commitment not to invest in companies that derive 30% or more of their revenue from coal-produced energy, and not to insure the construction of new coal-fired power stations or the operation of new mines.

New measures

MAPFRE recently tightened its underwriting policy with measures aimed at not insuring the construction of new infrastructure connected with coal mines or thermal power plants, as well as not underwriting new risks linked to tar (or oil) sands, or to projects linked to oil or gas in the Arctic. MAPFRE is currently working on a new Corporate Environmental Footprint Plan. It successfully completed its previous one, through which the company managed to cut emissions by 56% — almost triple the expected reduction.

Specific actions to protect the planet

We implement eco-efficiency measures in buildings to save energy, water, and paper.

We invest in 100% renewable energy sources.

We promote sustainable mobility among employees and customers.

We help small- and medium-sized enterprises calculate their carbon footprint.

We reduce the amount of waste, and we recycle. The company’s headquarters is already on its way to becoming zero-waste.

We develop specific insurance for hybrid and electric vehicles.

We raise awareness about caring for the planet among stakeholders.