TEXT DANIEL BADÍA | IMAGES ISTOCK

The COVID-19 coronavirus, which began in the Chinese town of Wuhan, spread out like an oil slick over the rest of the planet in a matter of weeks. Its consequences have ripped up all the forecasts, with situations in many cases never before seen, not even in times of war. An unemployment rate in the United States that could reach 20 percent, or GDP figures collapsing by over ten percent in the world’s leading economies, reveals the gravity of the situation. But the world is now facing a new phase, once the pandemic has been controlled and there is greater knowledge of the virus, while we await an effective vaccine: reconstruction.

MAPFRE launched a financial newsletter to reflect the most relevant opinions of MAPFRE Inversión experts, both the asset manager MAPFRE AM and the financial advisory wing MAPFRE Gestión Patrimonial, as well as MAPFRE Economics, the research service of our insurance group. There now follow some of these reflections on the impact of this crisis on the economy, on financial markets – mainly with regard to the asset management business – as well as the consequences for the insurance sector, many of which are reflected in the leading national and international media:

Manuel Aguilera, General Director of MAPFRE Economics:

Globalization and COVID-19: a public policy lesson(26/03): “Today, the COVID-19 coronavirus pandemic is revealing to us a new facet of the risks associated with building a global society. This is undoubtedly the first major health crisis in this new phase of the world; a crisis which, regardless of the lethality of the virus responsible for it, has managed to acquire the dimensions it has thanks to the interrelation and interdependence that characterizes economic and social activity nowadays. It could be said that the COVID-19 crisis is the definitive proof that the world is already one global society. This new crisis — still growing, but one whose implications are already at least equivalent to those of the greatest economic crises in the history of the world — will leave us with many lessons, but there is one that we can already add to the list of unfinished business for the global society. Unlike the risks associated with natural and human disasters, as well as the functioning of the financial markets, our global society has not prepared itself properly to deal with pandemics, not just in terms of addressing the health risks themselves, but also the consequences arising from the containment measures.”

Gonzalo de Cadenas-Santiago, Director of Macroeconomics and Financial Analysis at MAPFRE Economics:

COVID-19 and the threat for emerging nations (2/04): “Over the last decade, the emerging nations have experienced increased financial and debt vulnerability within a context of lukewarm economic growth, slowing trade, sluggish real investment, and growing income inequality. Countries that were already at high risk of sovereign external debt problems at the end of 2019 are presently facing an unsustainable debt burden. Total debt is estimated to be close to 200 percent of the emerging markets’ GDP, with private debt close to three quarters of this, mostly due to the expansion of private-sector leverage. This increasingly complex, dangerous, and fast-growing indebtedness does not augur well for their ability to withstand another external shock like that caused by COVID-19, especially when the liquidity position of these markets is so severely threatened.”

G20 vs. COVID-19 (16/04): “Instead of seeing nations fight each other, the need for better coordination should be reflected at least this time, with the G20 making an effort to break down trade barriers when it comes to drugs or medical equipment, and increasing funding for vaccine research and medical assistance for the poorest nations. It will also be necessary to continue supporting the global economy and better prepare for future pandemics and other global risks, including climate change.”

A new ‘Made in China’ world after COVID-19? (30/04): “This pandemic could accelerate pre-existing plans to reduce dependence on the supply chain from China. In addition to rising labor costs, the escalation of the trade tensions between China and the United States had already prompted a host of global companies to reassess their total dependence on China’s (state) firms.”

Ricardo González, Director of Sectoral Analysis and Regulation at MAPFRE Economics:

Why the insurance industry’s balance sheets withstand these crises better (24/04): “High volatility and falling asset valuations in the financial markets can have a significant impact on insurance companies’ balance sheets. The main component of these companies’ investment portfolios is fixed-income securities. A steep increase in the risk premiums for these securities has a direct impact on their valuation, which also falls sharply, ever more so the longer the duration of the bonds held in their portfolio (…) the composition of the investment portfolio is especially relevant. Those markets in which investments are primarily in sovereign bonds – backed by the asset-purchase programs of their respective central banks – have a more limited risk. The Spanish insurance sector is a paradigm in this regard, given its distinctly conservative traditional nature, in which Eurozone sovereign bonds are the predominant investment vehicle. The situation we are currently in, as a result of the COVID-19 pandemic, means that the Spanish sector is better placed than other markets where investments primarily in corporate bonds which, in this kind of situation, tend to suffer swifter transitions in their credit ratings and this can leave them below investment grade or even cause them to lapse into an insolvency scenario.”

José Luis Jiménez, MAPFRE Group Chief Investment Officer:

The coronavirus and asset management (8/03): “If passive management had been gaining market share in recent years, a turning point may now have been reached. Now is the time for active management, for a human manager with capacity for analysis and discernment in the face of a novel distortion, judging the economic, business, social and psychological aspects. Probably, ETFs, robo-advisors, algorithms, risk premium management, high frequency trading, etc. are going to face complicated times (…) In this context, there will most likely be highly significant progress in the consolidation of the sector. Solvent enterprises, with a strong brand image and, above all, with liquidity, will lead the process.”

From Greek Myths to Knowledge Biases: Another Way to Understand the Crisis (26/03): “Given the tremendous uncertainty about the future and the latent losses that may exist in investment portfolios, it is important to turn to behavioral finance in order to avoid predictable errors. Thus, if we use Professor Kahneman’s analogy when seeking an explanation for the current uncertainty, it is very likely that most of us will afford greater importance to our System 1 (the one that is principally based on instinct and heuristics, i.e. on quick, straightforward explanations) than to System 2 (which calls for logical thinking and involves greater effort) (…) The current situation can be a great opportunity for all those investors who utilize their System 2, avoiding biases and investing in good companies with certain competitive advantages – little debt, a lot of cash – and at very attractive prices.”

The Dilemma of the Euro and COVID-19 (7/05): “The question of issuing coronavirus bonds or mutualizing debt in Europe highlights the same doubts as those that arose with the Euro crisis. Is monetary union, as it has been conceived, a project that is bound to fail, or is the lack of progress on closer integration (banking, fiscal, and even political union) the cause of its instability? It is perhaps at this point that we should take a look back and recall the origin of the European project so as to understand its importance. Those economic policies to impoverish neighbors after the Great Depression and the two world wars that took place in Europe were sufficient grounds for creating a union of countries that would not make the same mistakes again. Today, when we are back at the crossroads, it is important to focus on the long term and see the true dimensions of the problem, beyond the merely economic aspect.”

Alberto Matellán, Chief Economist at MAPFRE Inversión:

Economic forecasts and alternative tools (7/05): “We can take advantage of losing the assistance of forecasts which set forth clear scenarios in order to become better investors. Being deprived of that convenience leads us to examine our investor practices in greater detail, expand our conceptual framework, and turn to more varied information sources. In short, in the case of professional managers, providing a better customer service in the form of operational efficiency or new products aligned with the socioeconomic reality. But also in the case of consultants; in this context, individual savers have an advantage they are often not aware of: they do not need to rely on such scenario forecasts, as they already come equipped with them. If they are well-informed, their own investor profile is what guides their investments, regardless of the economic context and emotional fluctuations. Something as simple as reminding them of this and helping them maintain discipline can also help advisors add more value.”

Eduardo Ripollés, Institutional Business Director at MAPFRE AM:

Impact of the crisis on mutual funds: a new boost for ESG (2/04): “In turn, I’m convinced that investments with ESG criteria will be further strengthened after this crisis. I’m not just referring to the growing range of thematic funds, always separating the wheat from the chaff, of course. Rather, given the increasingly pressing need to incorporate these criteria into traditional funds, no longer just by fund management teams, but also because of the demands of professional investors who, from now on, will finally be joined by individual investors. Three letters, three themes, and three ways to comply with the United Nations SDGs, but with the S playing a stand-out leading role as a result of the crisis we are experiencing.”

He who surpasses a crisis surpasses himself (7/05): “The institutional mutual fund market is going to be a clear example of the changes and new ways of dealing with a changing market with new demands, to which all of us in this industry will have to adapt (…) Active management is the way to put in the hands of professionals the appropriate selection of portfolios that can readily beat the market and generate value for investors. This reasoning is valid for Fixed Income, Equities and, of course, applies equally to both Mixed and Profiled Funds.”

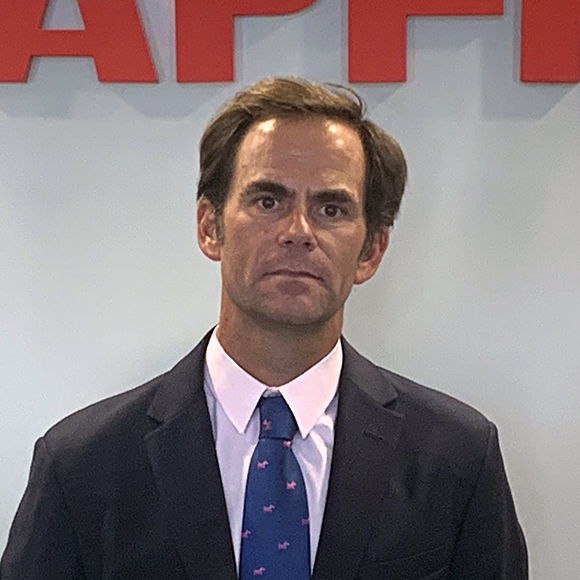

Patrick Nielsen, Assistant General Director of MAPFRE AM:

Tomorrow’s World (8/04): “The coronavirus crisis surprises us in a great many ways, with new scenarios that, until just a few months ago, could have been pulled straight out of a science fiction movie (…) First of all, focus on the analysis. We all know that emotions offer really poor advice in financial decisions. The emotional toll of the current situation is tremendous. We must counter this with a greater dose of analytical work (…) Secondly, financial solidity and quality management must take precedence. Additionally, there is the need for greater flexibility; seeking liquid investments, companies present in several geographical regions and active in several product or business lines (…) Fourthly, we must design a map. Creating a mental map of what tomorrow’s world will look like enables you to react more quickly when the inevitable surprises arrive (…) Therefore, this crisis will mark a true turning point, acting as a catalyst for changes that were already brewing. In tomorrow’s world, fund managers must be prepared to make investment decisions in a very different way from our pre-COVID approach.”

Luis García, MAPFRE AM fund manager

Investing when the calculator breaks (26/03): “The fears and emotions that distance us from rationality are even greater when ‘black swans’ appear (…) Fear prevents us from being able to calculate the odds correctly. Even in these times, it is reasonable to believe that many companies will be able to keep going and that, at some point, sooner or later, they will return to normal operation. As investors, it is important to always choose those companies that are most likely to overcome a crisis, even when it is as tough and unfair as this one. Precisely in order to try to have the odds in our favor, one of the conditions we demand of companies that are to become part of our portfolio is that they can claim to be in a comfortable financial position. If they have a net cash account (i.e. more money in the bank than the debts they have to pay), even better. Although that alone is not enough. For this reason, another feature a company must have for us to set our sights on it is that it has a management team we trust. We are looking for brilliant managers with a history of doing things right. This experience has taught us the importance of the human factor. Business is all about people. Good managers generate cash, they don’t destroy it. In the toughest of times is when we enjoy greater peace of mind knowing that our money – and that of our co-investors – is in the hands of great professionals.”

We can now go out and do sport, so why not invest in it? (7/05): “On Saturday, April 25, the Spanish prime minister announced that, as long as the evolution of the pandemic continues as expected, the next group in our country, after the children, allowed to go out will be those people wishing to take exercise outdoors. Yet again, this decision highlights the remarkable, increasingly important role that sport plays nowadays in our society. However, while society has long afforded it the importance it deserves, sport maintains a relatively low profile as a global investment trend with tremendous potential (…) The fact that it remains a sector overlooked by many investors gives us the chance to find excellent companies in it trading at prices which, in our opinion, are really attractive, especially when we look at Europe. Over recent months, we have been increasingly analyzing this industry in greater depth. Today, sports-related companies account for more than twenty percent of the MAPFRE AM Behavioral Fund portfolio. This is a European equity fund with which we are attempting, precisely, to study market psychology in order to detect this kind of opportunity.”

Michael Morossi, MAPFRE AM fund manager:

Investing in Good Governance, a Crisis Vaccine (16/04): “There’s nothing like a crisis to test our resolve and challenge our assumptions. In addition to washing our hands copiously, we have spent the last few weeks reflecting heavily on our investment process and adopting prudent measures that will enhance the quality and long-term performance of our portfolio. MAPFRE AM’s Good Governance Fund invests in one percent of the most important leading businesses worldwide. With a concentrated portfolio of 30 companies and a universe of more than 3,000 companies to choose from, we can afford to be selective when it comes to choosing who to invest in. We have seen that our focus on governance as the main thrust of our ESG analysis has served us well during this exceptional period (…) Our plan, as ever, is to continue acting prudently, with humility and without compromising our strategy of investing solely in the best leading businesses in the world. There may be days or weeks when things don’t go well for us, but we are emerging from this crisis with even greater confidence in the long-term merits of our investment process and its focus on governance.”

César Gimeno, American equities and multi-asset portfolio manager at MAPFRE AM:

COVID-19: a unique event in a different world (24/04): “Two major changes have been developing over the last few years. Firstly, there has been a tremendous increase in the speed of information transmission (especially thanks to the Internet and social media) and, in addition, new investment instruments have been created and made available to those involved (ETFs in particular). These two elements are very different from those we had years ago, like when the 2008 financial crisis occurred (…) In a scenario of great uncertainty like the current one, our recommendation is based on refraining from radically changing our investment strategy. It cost us so much to design and takes into account both our admissible level of risk and our investment horizon. Volatility, regrettably, is here to stay in this new world, and this cannot be blamed solely on COVID-19.”

Daniel Sancho, Head of Investments at MAPFRE Gestión Patrimonial:

Volatility is relative (26/03): “The time horizon is once again key when it comes to building portfolios. In order to discover what risks and volatility we wish to assume, we need to know how long we are willing to maintain the investment. It has always been said that profiles with a long-term investment horizon are riskier, when, in practice, this is not necessarily true. As time goes on, we’ve seen that, if you avoid being scared by short-term volatility and manage to focus on the long term, your risk will be progressively reduced as you’ll have more time to temper the volatility of the portfolio. In order for the theory to be fulfilled in practice, it is imperative that we keep our word and remain psychologically strong. In times of tension such as those we are now experiencing, we will be forced to remember what our investment horizon is, and we will also have to remember that daily volatility is not the same as monthly volatility or annual volatility. In this way we will realize that volatility does not have to be scary and we will simply have to do our best to relativize it.”

All your eggs in one basket? (7/05): “As of today, the situation has changed radically, given that the alternatives we have for investing in our immediate surroundings are not so attractive. This means that we have been forced out of our ‘comfort zone’ and had to look at other regions or other assets. The market and the evolution of the different assets has continually reminded us – and taught us – that one of the most important considerations to bear in mind when building a portfolio is diversification and, for the retail investor, the best product is without any doubt a mutual fund (…) It is important to always remember that, should you decide to put all your eggs in one basket, that basket must be well constructed, with well diversified and, of course, well advised contents.”

Ismael García Puente, Investment Manager & Fund Selector at MAPFRE Gestión Patrimonial:

What happened to my Fixed Income fund? (2/04): “Conservative investors may have been ‘relatively’ calm about their equity position, as they were not exposed to stock-price fluctuations. However, their relative peace of mind probably evaporated as soon as the details of their investments were updated. If you have a good advisor, you may have heard them tell you recently that: ‘fixed income is neither income nor fixed’ and, at that precise moment, looking at your financial statement, those words that went unnoticed are now very much present (…) From this moment onward, your fund’s ability to bounce back from losses will very much depend on the quality of the management team in charge of it and the flexibility with which it has acted in these stressful times.”

Techniques for riding out market irrationality (24/04): “The sharpness of the plummeting company valuations and the indiscriminate nature with which this has occurred are totally unparalleled (…) However, the truly irrational thing is when a stock market considered efficient no longer distinguishes between price and value. In times of stress, this dislocation becomes really extreme and the law of supply and demand cannot serve as a mechanism for discerning the fundamental value of the businesses in which we invest, whether directly or by way of mutual funds. Moreover, time horizons are considerably shortened due to uncertainty, and investors start thinking in terms of days or weeks, rather than months or years. However, most of the companies in which the leading investment fund managers invest are capable of generating profits on a sustained basis over time, and this reduction in one-year results entails a very small decrease in relative terms, with respect to the real value of the business as a whole (despite the fact that the price indicates otherwise). Fortunately, the market usually readjusts these inconsistencies, albeit rather slowly, and so it is vital to be patient.”

Javier Lendines, General Director of MAPFRE AM

Five key questions investors must ask in order to tackle the crisis (26/03): What is the time frame for my investments? What is my level of risk tolerance? How much money am I willing to lose? Do I try to keep up to date with economic and business developments? Do I attempt to diversify my information sources? As a manager, I feel there are as many portfolios as there are clients; however, for a medium-term investment horizon, I would make the following observations. With regard to fixed income, while official rates will very likely remain at reduced levels for a long time, I would avoid long-term investments given that, in the event of increased market returns on assets, their prices tend to react negatively. As for equities, after a fall of more than 40 percent from the year’s highs, if the investor’s time horizon is really medium term, the current levels are attractive for taking market positions. It is advisable not to invest the full amount available for investment on one single occasion. Should further corrections occur, a certain percentage must remain available so as to be able to continue investing.”